In April of 2022, this blog reviewed changes in stock market performance in the year prior and also the just over six weeks period subsequent to the Russian invasion of Ukraine launched February 24, 2022. This blog updates the review to cover the post invasion experience 1-year later in two parts:

For the full year of February 24, 2022 to February 24, 2023; and

For the most recent portion extending from the 2023 New Year to present or year-to-date (YTD).

As with last year’s review, the analysis is organized to cover the 11 key sectors of the U.S. economy as included with the S&P 500 index. Not surprisingly, stock performance by business sector since this New Year’s Day varies considerably from that of the full year since the Russian invasion — with implications for the rest of 2023 if not beyond.

The Full Year Look

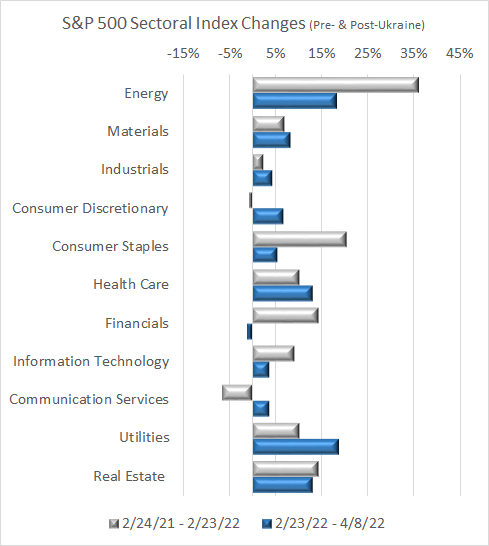

The graph below depicts performance for the full year since the invasion (shown by the gray bars) vis-a-vis the most recent experience since the start of 2023 (blue bars). For the full year:

The S&P 500 index declined by 6.0%. This was greater than the 1.0% valuation loss of the Dow (DJIA) and the 2.8% loss of the Russell 2000 index but much less of a loss than the 12.6% valuation decline of the Nasdaq.

From a sector-by-sector perspective, the energy sector was the big winner — with a 26% year-over-year valuation gain (much of which occurred early on around initiation of the Ukrainian conflict).

At #2, industrials came in well behind #1 with a valuation gain of just under 5%. The only other sectors showing (modest) valuation gains were utilities and health care.

The other seven S&P 500 sectors all showed losses for the year led by communication services (with a 22-23% valuation loss). The long vaunted information technology sector experienced an 8% sell off of market value.

Focus on 2023 YTD

Performance of the market since the 2023 New Year (shown by blue bars) is considerably different from that of the full year since the invasion:

For the S&P 500, the market has reversed the full year loss to indicate a gain of 3.4% since opening day of January 3 — although much of this gain happened in January followed by much weaker performance in February.

The consumer discretionary sector (i.e., higher end purchases) has been the strongest performer, up by just over 11% YTD. This is a major reversal of its 10th place full year performance compared to what has occurred in less than the last 60 days.

Six other sectors have experience positive YTD valuation performance — ranked in order as a resurgent information technology sector, then communication services, materials, financials, real estate, and industrials.

Four sectors have experienced valuation losses for YTD 2023 — led by utilities at a negative 6%. As the star valuation gainer of the early Ukranian experience, energy has gone from # 1 performer for the full year to #9 when considered for the more recent time frame since the 2023 New Year (with valuation loss of 4%). The other two sectors showing valuation losses YTD are consumer staples and health care.

Looking Ahead

The remainder of 2023 offers the prospect of continued volatility for the stock market — across the spectrum of institutional, professional and individual investors. With experience of the Great Recession followed a decade later by the COVID pandemic, both now largely in the rear view mirror, attention turns to the continuing and most recent dynamics of market and economic transformation — both domestically and globally.

The forces of this transformation include transitory and structural inflation, supply chain reshoring, labor force and housing shortages, a rapidly aging population, declining productivity and need for automation, uncertain trajectory of energy transition, financing lock-down, and both domestic and global balkanization. These forces pull in multiple and often changing directions. All have been catalyzed by COVID and now Ukraine.

Fasten the seat belts — for a wild and woolly 2023 — hopefully leading to a better vision of new, new normal looking beyond this year to the remainder of the decade.

For comments on this blog post or to request inclusion on my email notification list for future E. D. Hovee blog posts, please email me, addressed to: ehovee@edhovee.com

Also note: A listing of and links to past blog posts is available at:

Blog Post Listing.