Ukraine’s humanitarian crisis is re-ordering the contours of the U.S. and global economy. A leading indicator of this change is provided by the shifting sands of the the stock market. What remains to be seen is whether and how the war and these market shifts persist in the months ahead.

Comparative Stock Indices

We begin by reviewing the changes in four major stock indices in the year prior and the just over six weeks period subsequent to the Russian invasion of of February 24, 2022. What has been surprising is the resilience of the market even with the shock of the Russian invasion coupled with on-going concerns with surging inflation and residual COVID uncertainty. As illustrated by the following graph:

The Dow index comprised of 30 of the largest U.S. companies actually has increased by more post-invasion than over the full year prior to the invasion. The Dow peaked on January 4 of this year, dropping by 10% over the next month and one-half to February 23 (the day before the invasion of the Ukraine). In effect, the nearly 5% gain experienced since then covers only about half of the pre-invasion loss with growing market uncertainty leading up to February 24.

Of the four indices reviewed, the S&P 500 representing 500 leading publicly traded companies experienced the strongest gains leading up to the invasion and the most substantial recovery since.

The Nasdaq index, a composite of more than 3,000 stocks including REITs, experienced a net loss over the course of the pre-invasion year for those investors that did not pull out of the market by early 2022 — but with the 2nd strongest recovery from February 24 - April 8.

And the Russell 2000 which represents 2,000 of the smallest publicly traded companies is associated with the greatest valuation loss for those investors who did not exit these stocks before February 24 and the slowest recovery since.

Added Notes: In the year pre-invasion, index values peaked in later December/early January for the Dow and S&P. Peak values were experienced somewhat earlier in November for for the Nasdaq and Russell 2000 indices. Values to date in 2022 bottomed out on March 8 for the Dow and S&P, with the trough experienced a few days later on March 14 for the Nasdaq and Russell 2000. The day before the invasion (February 23) was the 2nd or 3rd lowest value of the year to date depending on the index considered.

Index Valuation Changes by Sector

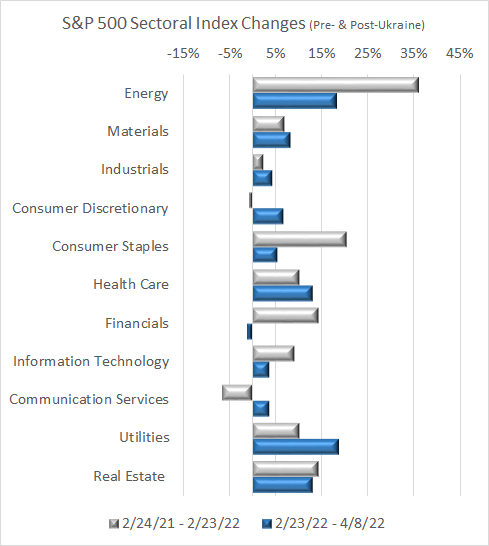

This review now transitions to a more in-depth consideration of valuation changes by stock sector. As the best performing index both pre- and post-invasion, this analysis draws on the experience of the 11 primary sectors as categorized for S&P 500 stocks.

As with the major indices, changes are compared both pre- and post-invasion for each of 11 sectors — as illustrated by the graph below. Most notable is the apparent shift in which sectors are hot versus what’s not.

For these 11 overall S&P 500 sectors, it is noted that:

Energy represents the #1 most rapidly appreciating sector pre-invasion and #2 growing sector in the 6+ weeks since February 23. Market valuations in this sector started coming on strong in early 2021, then slackening through late summer, then further ramping up from January 2022 to present.

As a major consumer and distributor of energy, utilities have moved up from 6th of 11 sectors pre-invasion to become the strongest gainer since February 23. What has been a relatively sleepy sector of the economy is now more front and center — both now and likely for much or all of the duration of the Russian-Ukrainian conflict.

Over the pandemic prior to the current crisis, consumer staples represented the 2nd most rapidly appreciating sector of the market — now fading post-invasion to 7th position of the 11 S&P sectors. This is also a sector affected by pressure for more value shopping as consumers adjust to inflation — worsened by disruptions of key agricultural exports from the Ukraine and Russia.

Valuations for information technology and communication services peaked in the latter months of 2021 and have waned since — in response to factors ranging from inflation to public frustration with big tech. A question on the horizon is how these and related sectors regain their luster and public trust. Of pivotal importance is the need for increased U.S. semiconductor capacity to remedy constraints across other sectors (ranging from industrials to consumer staples and consumer discretionary spending).

Real estate has maintained a position of relative strength — at position #3 pre-invasion and slipping only slightly to #4 so far post-invasion. Commercial real estate remains challenging and home refinancing activity has plummeted. Industrial/distribution demand remains strong. This has also been the case with new home sales — but for how long as residential prices and interest rates rise, inevitably pricing more out of the market.

Even as the COVID pandemic recedes, health care has improved its relative stock standing — moving up from 5th to 3rd position as management shifts from crisis mode back to the full portfolio of other temporarily underserved health needs.

Materials have been the sleeper but are now moving up from 8th to 5th spot — now highlighted by short- and long-term ramifications of the Russian-Ukrainian conflict. Materials including rare earths coming in large part from unstable and hostile regions of the globe are pivotal to the long-term shift from fossil fuels to clean energy. Finding solutions will be dependent on investment in sources more stable and accessible to the domestic and global market.

Financial stocks appear to be downshifting from 4th to 11th position as recent and likely continuing interest rate hikes affect loan demand, bond and loan valuations, and resulting earnings growth. Deposits are also exiting financial institutions as savers look to better opportunities in the as yet unfamiliar environment of increasing interest rates.

Last but not least, consumer discretionary spending and associated business valuations have been improving as COVID shifts from pandemic to endemic but predicated on further return to travel and vacations now made less certain by the combined effects of global instability, auto availability and inflation plus residual concern with potential COVID resurgence.

For at least the near term, expect continued focus on a return to the basics — addressing continuing if not increased instability of key supply chain bottlenecks — affecting the full range of market sectors. What have been the less glamorous sectors of materials, energy and utilities now take on more prominence with needs for greater innovation and resulting opportunity for return on investment.

Bottom line, the Russia-Ukraine conflict together with the growing China - U.S. rift highlight the need to re-balance the dynamic between global interdependence versus national or regional self-reliance. For humanitarian and economic perspectives, the most viable solution should not be about “either or” but rather “both and…”