Across the U.S. and globally, artificial intelligence (AI) is now working its way into every facet of human experience. Increasingly, there is the opportunity for AI to affect and possibly even direct public policy. To test how this might occur in the spheres of economic policy making, ChatGPT has been engaged a 2-step process to:

Assess the effectiveness of responses by the U.S. Federal Reserve to periods of high inflation in the post World War II era, and then …

Identify policy measures that appear most appropriate at this time through the remainder of the current inflationary cycle.

Initial Query & CHATGPT Response

The following discussion is quoted in its entirety from a query (by Eric Hovee) together with immediate ChatGPT response as of October 13, 2023. The initial query/response cycle leads to a follow-up question and ChatGPT response.

Note that ChatGPT frames its answers in terms of a first-person response.

INITIAL QUERY:

Statutory mandates of the U.S. Federal Reserve Act are to “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” Other non-statutory performance metrics often considered include housing affordability, access to small business financing, and debt service costs of the U.S. government. Of the periods of significant inflation in the U.S. since World War II, in which inflationary periods did Fed policy achieve the best results in terms of both statutory mandates and other key metrics of national economic vitality? Conversely, in which periods did Fed policy result in the least effective outcomes? And why?

CHATGPT RESPONSE:

The effectiveness of Federal Reserve policy in achieving its statutory mandates and other economic metrics can vary over time due to a complex interplay of factors, including economic conditions, government policy, and external events. It's essential to consider that the Federal Reserve's policies have evolved over the years, and historical economic circumstances differ, making direct comparisons challenging. Let's look at some periods of significant inflation in the U.S. since World War II and assess how the Fed's policies fared in terms of its mandates and other metrics:

1. The 1970s - High Inflation:

Effectiveness: The 1970s were characterized by high inflation, rising unemployment, and volatile interest rates. The Fed was initially slow to respond to rising inflation, partly due to the belief in the Phillips Curve, which suggested a trade-off between inflation and unemployment. Eventually, the Fed adopted a more aggressive stance under Paul Volcker's leadership, leading to high-interest rates but ultimately taming inflation.

Achievement of Mandates: The Fed's policies in the late 1970s and early 1980s led to a temporary recession but eventually brought down inflation and contributed to price stability. However, it resulted in high unemployment rates in the short term.

Other Metrics: The housing market and small businesses suffered due to high-interest rates, but once inflation was under control, these sectors could recover.

2. The 1980s and Beyond - Low Inflation:

Effectiveness: After successfully controlling inflation in the early 1980s, the Fed adopted a more flexible approach, focusing on maintaining price stability while promoting economic growth. This led to lower inflation rates and moderate interest rates throughout the 1980s and beyond.

Achievement of Mandates: The Fed was more successful in achieving its statutory mandates during this period. Inflation remained low, unemployment decreased, and interest rates stabilized.

Other Metrics: Housing affordability and access to small business financing generally improved as interest rates became more predictable and affordable. The U.S. government's debt service costs also became more manageable.

3. The Late 2010s and Early 2020s - Low Inflation:

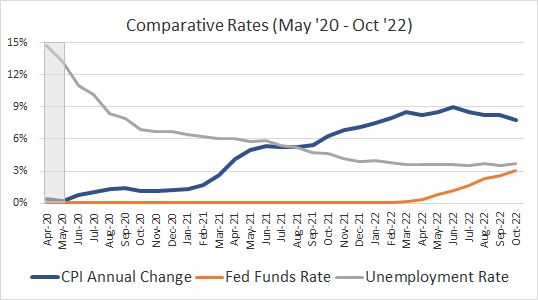

Effectiveness: The period following the 2008 financial crisis saw the Fed employing unconventional monetary policies, such as low-interest rates and quantitative easing, to stimulate economic growth. This continued into the early 2020s when the COVID-19 pandemic hit.

Achievement of Mandates: The Fed's policies during this period aimed to stabilize the economy and promote employment. Inflation remained relatively low, but employment improved.

Other Metrics: Low-interest rates generally made housing more affordable, and small businesses could access financing more easily. The U.S. government's debt service costs remained low due to low-interest rates.

In summary, the effectiveness of the Federal Reserve's policies in achieving its mandates and other economic metrics has varied over time. The 1970s were marked by challenges in controlling high inflation, with short-term sacrifices in employment and housing affordability. The 1980s and beyond saw better outcomes in terms of inflation and economic stability. More recently, the Fed employed unconventional policies to address economic crises, which helped maintain low inflation and promoted economic recovery, but the long-term consequences of these policies are still evolving. The effectiveness of the Fed's policies is often a result of its ability to adapt to the unique economic circumstances of each period.

Follow-up Query & Response

ChatGPT’s initial responses prompted this blog writer to provide a follow-up question for ChatGPT suggested application going forward.

FOLLOW-UP QUERY:

Based on this experience, what policy measures appear most appropriate at this time through the remainder of the current inflationary cycle?

CHATGPT RESPONSE:

Determining appropriate policy measures during an inflationary cycle depends on the specific factors driving the inflation and the broader economic conditions. As of my last knowledge update in September 2021, I can provide some general guidance on what measures might be appropriate during an inflationary cycle. However, I recommend consulting the most recent economic data and analyses to make informed decisions. Here are some potential policy measures to consider:

1. Monetary Policy:

Interest Rates: The Federal Reserve can consider adjusting interest rates to combat inflation. Raising interest rates is a traditional tool to reduce consumer spending and borrowing, which can help cool down the economy and mitigate inflationary pressures.

Quantitative Tightening: The Fed can also reduce the money supply through the sale of government securities, which can have a similar impact on inflation.

2. Fiscal Policy:

Government Spending: Depending on the nature and severity of inflation, the government can consider adjusting its spending. Reducing excessive government spending can help reduce demand-side inflation.

Tax Policy: Adjusting tax rates, especially for higher-income individuals or corporations, can help reduce overall demand in the economy.

3. Supply-Side Policies:

Address Supply Bottlenecks: Identifying and addressing supply chain disruptions or bottlenecks that contribute to rising prices can be essential. This may involve regulatory reforms, increased infrastructure investment, or policies that encourage productivity improvements.

Promote Competition: Encourage competition in markets to reduce the pricing power of firms. Anti-trust enforcement can be used to prevent monopolistic behavior that can lead to price increases.

4. Wage and Price Controls (As a Last Resort):

If inflation becomes severe and persistent, policymakers may consider wage and price controls. These are generally seen as a last resort because they can have unintended consequences and are not typically favored in market-oriented economies.

5. Communication and Forward Guidance:

The central bank can use clear and transparent communication to guide market expectations. This can help manage inflation expectations and influence consumer and business behavior.

6. Global Economic Factors:

Consider international factors that may be affecting inflation. In some cases, inflationary pressures can be driven by global events or changes in commodity prices. Coordinating policies with other major economies can be important in such cases.

7. Data-Driven Approach:

Continuously monitor economic data and inflation indicators to inform policy decisions. The response to inflation should be data-driven and adaptable to evolving circumstances.

It's important to note that the specific policy measures chosen should be tailored to the unique circumstances of the current inflationary cycle. The severity of inflation, its root causes, and the broader economic environment will all influence the appropriateness of various policy measures. Consultation with economic experts and careful consideration of the potential side effects of any policy choices is crucial to making informed decisions during an inflationary period.