Will adoption of Artificial Intelligence (AI) prove to be a job killer or enhancer? This blog post addresses this question from three perspectives:

How the U.S. job base has adapted in the past to changes in technology, cultural and economic environment — an empirical exercise drawing on the experience of historically observed shifts away from agricultural and then manufacturing employment.

What these changes suggest for how employment in the future may occur with AI adaptation across a seemingly never ending realms of human endeavor — a more speculative undertaking albeit drawing on informed opinions of recognized research organizations.

How the U.S. might adapt to AI changing employment prospects in as-needed stair-step fashion — reflecting factors favoring full employment rather than net job displacement.

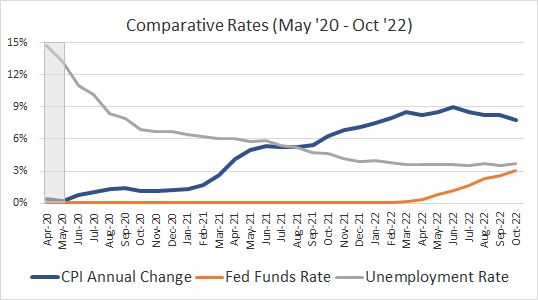

This overview analysis indicates that prior year transitions from agriculture and then from manufacturing resulted in their respective shares of U.S. employment dropping by about 3-5% points per decade. If this experience is applied to AI, it would suggest a pace of change that could be absorbed by offsetting job growth in tech-focused sectors of the economy.

If the pace of AI-driven change occurs more rapidly as some sources suggest, net results could be more de-stabilizing for American workers. Advance preparation for potential business, worker and regulatory mitigation should be considered sooner rather than later so that effective measures can be ready to go before the prospective negatives overwhelm market and/or regulatory capacities to effectively respond.

U.S. Economic Adaptation

Let’s begin by reviewing the fundamental changes that have occurred with employment in the U.S. over the last 150 years. In that period, the country has gone from agrarian to industrial to post-industrial.

Based on employment data available, the analysis is divided between two time periods:

1870-1930 - from post Civil War reconstruction to a 1st world war and to onset of the Great Depression.

1940-2020 — from economic recovery to a 2nd world war and to emergence of a baby boomer dominated culture.

1870-1930

As depicted by the following graph, the U.S. economy took off on a tear post-Civil War, increasing from what the U.S. Census Bureau defined as just under 13 million gainfully employed Americans in 1870 to approximately 49 million in 1930. This is close to a 4-fold increase and equates to an average 2.2% per year job growth rate.

Sources: U.S. Census Bureau. Comparative Occupation Statistics: 1870-1830 (Part II).

As defined by the Census Bureau, total “gainful employment“ includes workers age 10 and above.

The number of gainfully employed workers went from less than 34% of nationwide population in 1870 to nearly 40% by 1930. Labor force participation was augmented by an increasing presence of women in the workforce as well as child labor.

Children ages 10-15 accounted for 1.75 million workers as of a 1900 peak — equating to about 6% of all U.S. employees. Women went from 15% of the employed workforce in 1870 to 22% by 2030.

From an occupational perspective, America was still a largely agrarian society in 1870 with agricultural workers accounting for over half (53%) of all jobs. As depicted by the following graph, 60 years later agriculture’s share of the gainfully employed was cut by more than half — to much reduced 21% share. This was due to introduction of labor saving innovations ranging from rural electrification to replacement of horses by petrol-powered farm equipment.

Source: U.S. Census Bureau.

Averaged over this 60 year time frame as a share of total employment, ag-related jobs dropped by just over 5 percentage points per decade. With agriculture employment less dominant, employment growth shifted to other sectors of the U.S. economy.

Manufacturing went from 20% of U.S. employment in 1870 to 30% in 1920, then dropping somewhat to 29% in the depression year of 1930. Full uptake of the industrial revolution spread to other sectors of the economy — increasing from 27% of all jobs in 1870 to just under 50% in 1930. Major beneficiaries of this more diversified upsurge included transportation, trade, professional services plus what the Census termed as clerical occupations.

1940-2020

This period is bookended by a second world war at its outset, followed by steady economic growth (albeit also with cultural upheaval) and then more volatile years economically with entry into the 21st century. As illustrated by the following graph, U.S. non-farm employment increased from 32 million in 1940 to 142 million as of 2020 — a more than 4-fold increase over 8 decades.

Source: U.S. Bureau of Labor Statistics (BLS), Current Employment Statistics (CES) survey.

Note: BLS data sets use different definitions for the 1940-2020 period than for the earlier 1870-1930 Census Bureau data set and so are not directly comparable. CES data for the 1940-2020 time frame excludes farm employment. Separate BLS Quarterly Census of Employment and Wages (QCEW) data includes agriculture which as of 2022 now accounts for less than 1% of QCEW employment nationwide.

Even more importantly, the 8-decade period from World War II also marks the transition of a wartime and manufacturing led economy to a yet more diversified and service-focused job mix. The rate of job growth averaged 1.9% per year over this longer time period. This is somewhat below the 2.2% annual growth rate previously experienced as the nation was industrializing in part due to significant in-migration experienced from from 1870-1930 — albeit partially offset by increasing post-depression labor force participation over much of this most recent 80-year period.

Employment increased from 25% of population in 1940 to a peak of 47% in 2000, then dropped back over the next two decades to 43% as of 2020. As illustrated above, overall job growth also has stagnated over these past two most recent decades than previously from 1940-2000.

The post WWII era has not been kind to U.S. manufacturing — at least in terms of job share (as depicted by the graph below).

Manufacturing’s share of non-farm employment is now less than one third its share of employed workforce than in 1940 and 1950. From 31% of all jobs in 1940/50, manufacturing appears to have bottomed out a 9% share as of 2010/20 — equating to an average 3-4% point per decade drop in its share of non-farm jobs — but more stabilized this last decade from 2010-20. Uncertain is whether the current emphasis on re-shoring and shortened supply chains will prove to stem further domestic manufacturing employment erosion going forward.

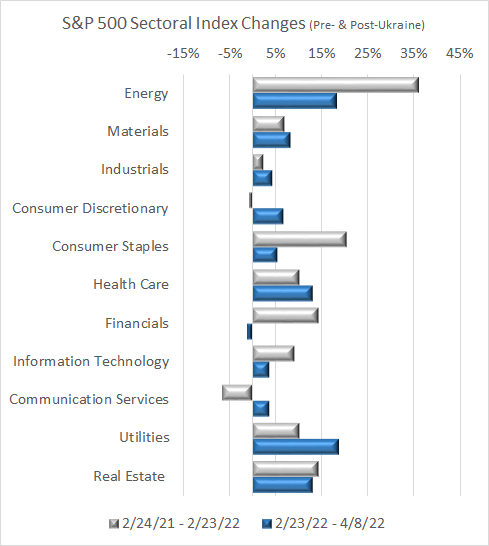

A grouping of key service sectors stepped in to fill the void left by manufacturing’s reduced job share. Led by health care and professional services, all together these growth-oriented services have gone from 40% of non-farm employment in 1940/50 to peak out at 67-68% as of 2010/20. Other components of growth-oriented services include information, financial activities, leisure/hospitality and government.

All other sectors have stagnated in terms of job share, together declining from 29% to 24% of domestic employment over the 80 years from 1940-2020. These other slower growing sectors include natural resource extraction, construction, wholesale and retail trade, and transportation together with warehousing and utilities.

Reconciling AI to Employment

With this historical background in hand, we now switch to the more futuristic consideration of potential AI impacts on U.S. (and global) employment in the decades ahead.

AI Categories

Two primary categories of AI are on the table as being utilized or considered currently and in the years immediately ahead:

Narrow AI (ANI) — as the most common form of AI currently, used for highly specialized systems designed and trained for specific task(s). Applications range from speech recognition to health diagnostics to autonomous driving.

Artificial General Intelligence (AGI) — currently a theoretical and not yet proven concept but a longer term goal of AI research covering any intellectual task that a human can perform.

A potential as yet more distant and hypothetical 3rd category of artificial intelligence is superintelligent AI (ASI) — popular in science fiction and as a philosophical concept — which in theory that could surpass human intelligence in every aspect.

Potential Employment Impacts of ANI Implementation

For purposes of addressing employment impacts immediately ahead, the current focus is on ANI.

Evaluations of potential AI job-related impacts have been conducted by a number of recognized public and private organizations in recent years. Forecast impacts drawn from nine representative studies are briefly summarized as follows — some specific to the U.S. and others offering a more sweeping international perspective:

U.S. Focused Studies:

Oxford University (2013) — estimated that about 47% of US jobs are at risk to automation, with occupations characterized by low education attainment and wages likely downsized due to the “probability of computerization.”

PriceWaterhouseCooper (PWC/2017) — projecting that automation may impact 38% of U.S. jobs by the early 2030s with financial service jobs identified as most vulnerable short-term and transport jobs longer term.

Brookings Institution (2019) — projecting 18% of jobs are highly vulnerable to automation and that “better-paid, better educated workers face the most exposure.”

U.S. Bureau of Labor Statistics (BLS/2022) — a detailed analysis of prior job changes but with no particular AI projected impact through this decade, albeit noting that prior projections of job losses have tended to overstate changes actually experienced.

Internationally Scoped Studies:

International Labor Organization (ILO/2016) — estimated 56% of all workers in Southeast Asia (Cambodia, Indonesia, the Philippines, Thailand, and Vietnam) are at risk of losing jobs over two decades with those in the garment industry especially vulnerable.

McKinsey Global Institute (MGI/2017) — estimated 400-800 million jobs will be displaced worldwide by 2030 (a 15-30% impact) — with half of of today’s work activities automated by about 2055.

World Economic Forum (WEF/2018) — with automation and AI displacing 75 million jobs with large multi-national firms by 2022 but more than offset by creation of 133 million new jobs .

Organisation for Economic Co-operation and Development (OECD/2023) — currently estimating 27% of jobs in selected OECD countries of North America and Europe are in occupations at high risk of automation with particular focus on workers surveyed in finance and manufacturing.

Goldman Sachs (2023) — observing that the shift in workflows triggered by a new wave globally of AI systems could expose the equivalent of 300 million jobs to automation over the next decade, but with GDP increased by 7%.

Not surprisingly, these studies vary widely in their estimates of potential AI-related job losses. While some focus only on displacement, a few suggest that employment gains may more than offset reductions.

Time frames of analysis, geographic scope and methodologies also vary between studies. Researchers who focus on specific job tasks impacted by AI rather than more generalized occupational groupings tend to be associated with lesser levels of projected job displacement.

Some studies suggest that those most at risk of displacement are in lower paid occupations while others indicate major shifts ahead for professional and technical jobs. While these studies note a range of factors affecting the AI transition, there appears to be little to no emphasis on the ongoing value of human to human interaction as potentially mitigating job loss estimates.

As concluded by BLS in its 2022 analysis, “It is entirely possible that robotics and AI are simply another in a long line of waves of innovation whose effects on employment will unfold at rates comparable to those in the past.” If this proves to be the case with AI, at least for the U.S. it would suggest alignment with agricultural and manufacturing experience of a roughly 3-5% point job displacement factor per decade. This would equate to a range of perhaps 4.5-7.5+ million U.S. jobs displaced by AI-implementation per decade.

There are those who contend that job displacement with AI may be more rapid and profound than what has occurred with historical employment transitions — as with shifts away from agriculture and manufacturing employment. The probability of more severe AI displacement effects increases dramatically if applications shift more rapidly than expected from narrow AI (ANI) to human equivalent general AI (AGI).

Hurry Up & Slow Down

We conclude this review with summary observations leading to thoughts as to potential strategic response for “taming the AI tiger.”

Summary Observations

Three summary observations can be drawn from this review of forecast AI related employment impacts in the context of what is currently known about AI coupled with the experience of historically observed job shifts:

Over the last 150 years, the U.S. has experienced and ultimately adapted to dramatic changes in the composition of employment — going from an agricultural to manufacturing and then service based economy with AI now clearly taking shape as the next major wave of economic and cultural change.

While as-yet there is no consensus on the pace and composition of AI-related job shifts, prior U.S. experience suggests that the ANI era now underway can unfold incrementally over a multi-decade period — absorbed in ways that maintain full employment and increase GDP for improved quality of life. However, these beneficial outcomes are by no means guaranteed.

There is a distinct risk that AI roll-out could break with prior precedent especially if rapid implementation leads to job displacement that significantly exceeds offset opportunities. Economic and societal risks to humanity are significantly increased if the pace of AI innovation moves too quickly from ANI to AGI (or even more dramatically to ASI).

Taming the AI Tiger

The uncertainty surrounding positive versus negative outcomes of AI implementation suggests the imperative for a substantial if not radical change to the social contract between workers, employers and regulators. Most important will be the need for more flexible, adaptable and resilient mechanisms suitable for responding to both anticipated and unanticipated change.

Some responses to AI implementation can be expected to exacerbate net job displacement; others to focus on AI that favors full employment for those ready and willing to engage in gainful employment. Some mechanisms will be essentially market driven; others likely will require governmental or other regulatory intervention.

AI Implementation Resulting in Net Job Displacement

AI rollout that exacerbates the risk of net job displacement in conjunction with economic and social disruption could result from some combination of the following factors:

Rapid Market-Driven AI Rollout — especially by multi-national firms with industry set protocols together with minimal regulatory oversight.

Open Borders Migration & Free Trade — further incentivizing global competition and risk-taking.

Preference for Non-Human Interaction — reflecting potential changed social preferences except for low skilled, low wage employment not readily amenable to AI market penetration.

Subsidized ANI — if aimed primarily to further accelerate AI proliferation with minimal economic, equity and cultural guardrails.

Next Step AGI/ASI — with human-like robots and superintelligence leading to increasing AI control of economic and policy-making capability even before ANI is fully absorbed.

AI Implementation Favoring Full Employment

Conversely, there are potential market-based and regulatory mechanisms that can serve to favor full employment for those who continue to be labor force participants. These include:

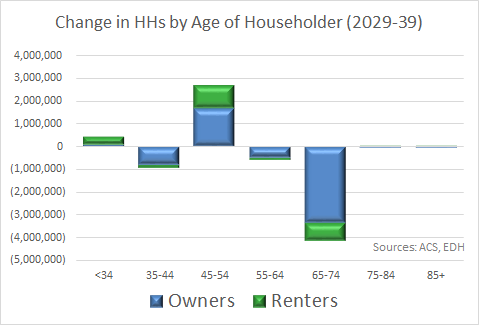

Slowed Population & Labor Force Growth — as expected with reduced birth rates for the foreseeable future — fortuitously as a cushion to absorb potential for net AI-related job displacement and incent higher wage jobs.

Workforce Upskilling — continuous life-cycle training for AI-work integration.

Preference for Human Interaction — marketed to consumer desire for personal service over unfettered robot/bot interactions.

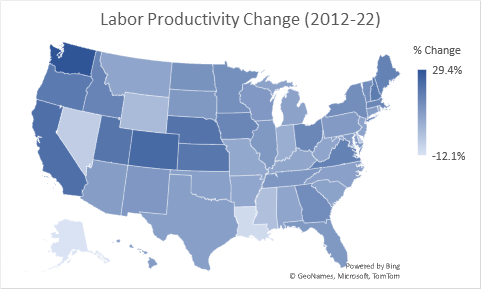

Employment Reshoring — with de-globalization at the cost of reducing labor productivity but maintaining key U.S. industries and associated jobs.

Governmental AI Regulation — aimed to match the pace of AI innovation with maintenance of full employment and social stability (and with carefully monitored R&D/commercialization of AGI/ASI).

Universal Basic Income (UBI) — as the end-all means offering fail-safe resources for workers displaced involuntarily or voluntarily with opportunity for individually determined artisanal entrepreneurship while retaining the incentive for gainful employment.

A Stair-Step Approach to Reconciling AI Implementation with Job Impacts

This blog post ends by suggesting a stair-step approach to recognizing and addressing AI effects in incremental step-by-step fashion, as needed. As illustrated by the following visual:

Going downstairs shows how AI may step-by-step result in ever more limited capacity to maintain full employment and income equity.

Conversely, the upstairs route depicts steps that might be considered and implemented to mitigate adverse impacts — supporting AI as a positive reinforcement to ever more gainful employment in a more prosperous world going forward.

Also illustrated with the graphic is the distinction between steps that are largely market-driven vis-a-vis regulatory and then those that reflect a hybrid market and regulatory approach.

Going upstairs need occur only to the extent that adverse job effects are being clearly experienced. Go only as far as needed at any point in time. But be prepared in advance so that effective measures can be ready to go before the prospective negatives overwhelm market and/or regulatory capacities to effectively respond.

This blog post has been prepared by from sources generally deemed to be reliable. However, accuracy is not guaranteed and information is subject to change without notice. Information regarding analysis of potential implications of AI for employment has involved use of material obtained from ChatGPT and Bing Chat inquiries, with separate fact checking conducted in preparation of this post.